28+ Business Bankruptcy Chapter 13

Total bankruptcy filing fees for Chapter 7 and Chapter 13 are 338 and 310 respectively. Any individual even if self-employed or operating an unincorporated business is eligible for chapter 13 relief as long as the individuals combined total.

Can A Business Owner File Chapter 13 Bankruptcy Steinberger Law

Here are some of the main differences between the two.

. Debtors must meet certain criteria to. Chapter 13 is bankruptcy for people who are making money but have fallen. You can use a Chapter 13 bankruptcy to help you pay back the IRS though if thats your only creditor you may want to discuss a repayment plan without declaring.

Small Business Repayment Plan Customarily reserved for individuals Chapter 13 can be used for small business bankruptcy by sole proprietorships. The filer can generally keep some assets such as a home. Chapter 13 can help an owner reduce personal debt such as credit card balances which can help a business stay open.

For Chapter 13 individuals must submit and implement a repayment plan for debts to be paid within three to five years. Chapter 13 bankruptcy is a reorganization bankruptcy typically reserved for individuals. A business filing Chapter 7 bankruptcy doesnt get a discharge either.

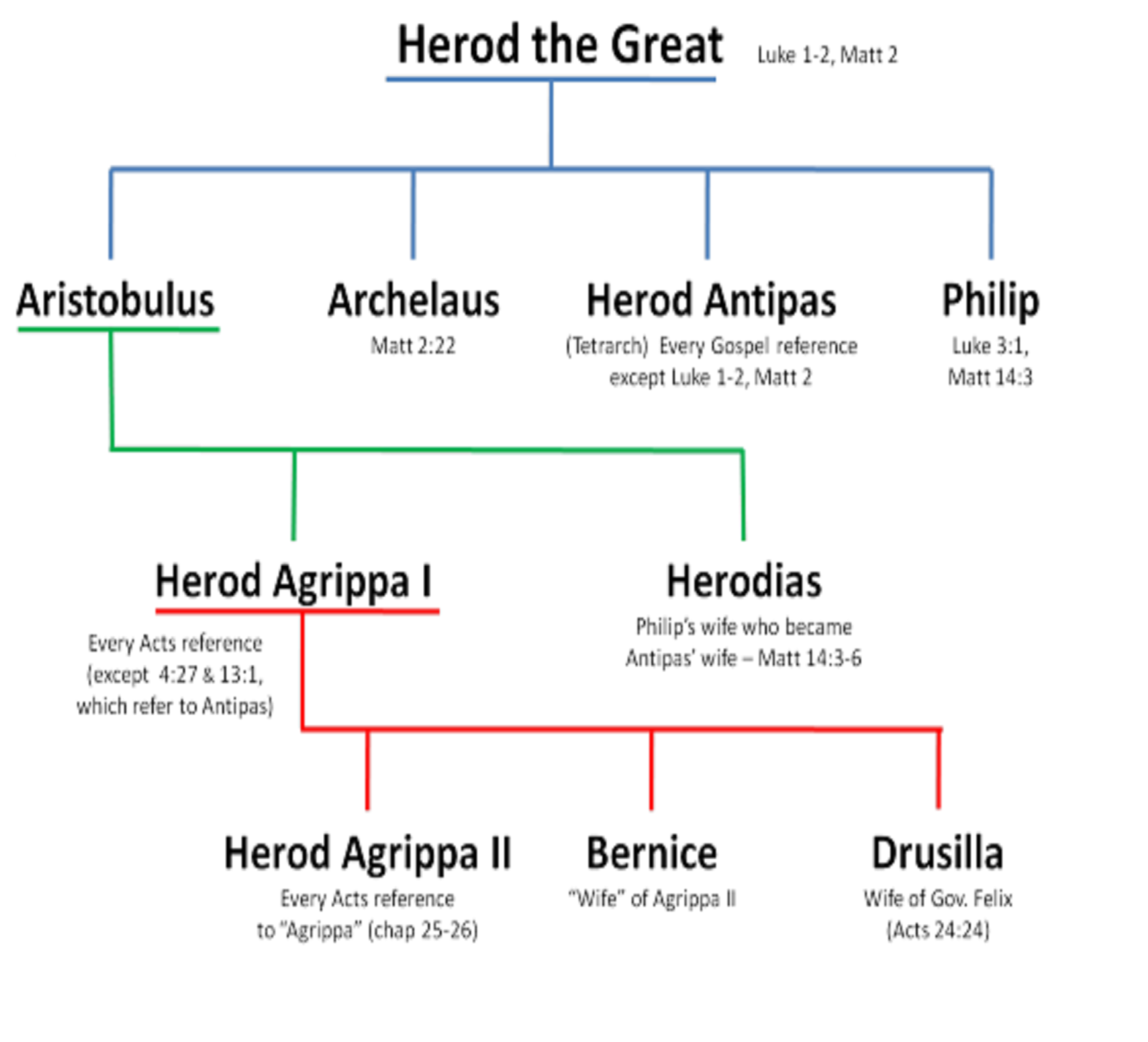

Heres how Chapter 7 and Chapter 13 bankruptcy differ. Under Chapter 13 a sole proprietor can file for personal bankruptcy and petition the court to reorganize their debts. Owners of the business are generally not liable for debt.

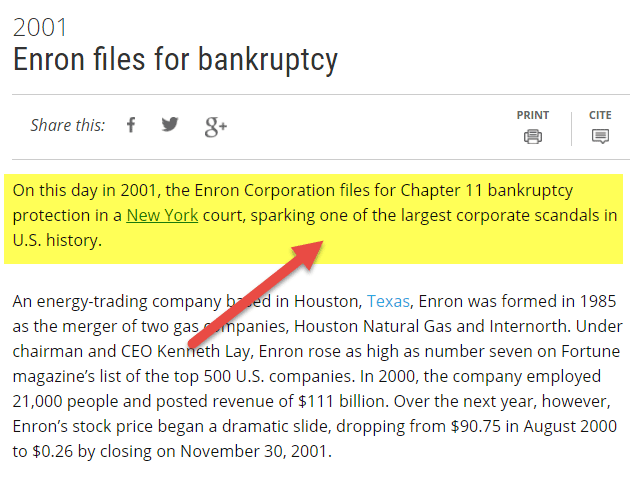

Bankruptcy proceeding in which debtors undertake a reorganization of their finances under the supervision and approval of the. What Is Chapter 13. Chapter 11 is a business reorganization bankruptcy that permits businesses to continue operations while also reorganizing debts through a debt repayment plan.

The key thing to remember is that as a sole proprietor you. The average attorney fees for the same chapters are 1450 and 3000. Chapter 13 refers to a US.

Under chapter 13 the Bankruptcy Court has the power to approve a chapter 13 plan without the approval of creditors as long as it meets the statutory requirements under chapter 13. The trustee will pay. Chapter 7 and Chapter 13 have many differences and it can be easy to confuse them sometimes.

You make monthly payments to the bankruptcy trustee assigned by the court to oversee your case. 1 in Chapter 7. Choosing to file for bankruptcy is a big decision but its the first of many that filers will encounter as they go.

Through business bankruptcy eligible companies debts are eliminated or put on a. Individuals have to participate in a means test to determine if they are eligible for a Chapter 7 or a Chapter 13 while businesses do not have to undergo this for a Chapter 11. It can be used for sole proprietorships since sole proprietorships are.

The Doraville Georgia-based company whose roots date to 1870 filed for Chapter 11 protection from creditors on Monday night with the US. Bankruptcy is a legal process available if you are unable to repay your debts. Instead the corporation ceases to exist.

But businesses dont file for bankruptcy as often as believed. The Chapter 13 repayment plan usually lasts three to five years. Chapter 13 bankruptcy is a plan that allows an individual or sole proprietor to reorganize and pay debts without liquidating assets.

Chapter 13 is sometimes called the Wage Earners Bankruptcy and for good reason. Bankruptcy Court in the Southern.

Eu Council Manual Law Enforcement Information Exchange 7779 15

800 Bankruptcy Lawyer O Fallon Mt Vernon Effingham Salem Granite City About Us

How Chapter 13 Works To Keep You In Control Of Your Assets

Buy Taxmann S Business Laws B Com The Most Updated Amended Student Oriented Textbook With Examples Case Studies Derived From Landmark Rulings Test Questions Practical Problems Etc Cbcs Book Online At

![]()

Understanding Chapter 13 Bankruptcy For Independent Business Owners In Need

Fauquier Times December 5 2018 By Fauquier Times 52 Issues Prince William Times 52 Issues Issuu

Memphis Tn Chapter 13 Bankruptcy Faq Hurst Law Firm

History Berlin Wall Art

Westlake Legal Group Northern Virginia Legal Practice

Taxmann S Insolvency And Bankruptcy Law Manual By Taxmann Issuu

Types Of Bankruptcies Chapter 7 9 11 12 13 Bankruptcy

Westlake Legal Group Northern Virginia Legal Practice

Types Of Bankruptcies Chapter 7 9 11 12 13 Bankruptcy

What Courts Look For In Chapter 13 Bankruptcies

What Is Chapter 13 Bankruptcy Experian

Chapter 13 Bankruptcy Explained

Robl Law Group Atlanta Bankruptcy Attorneys